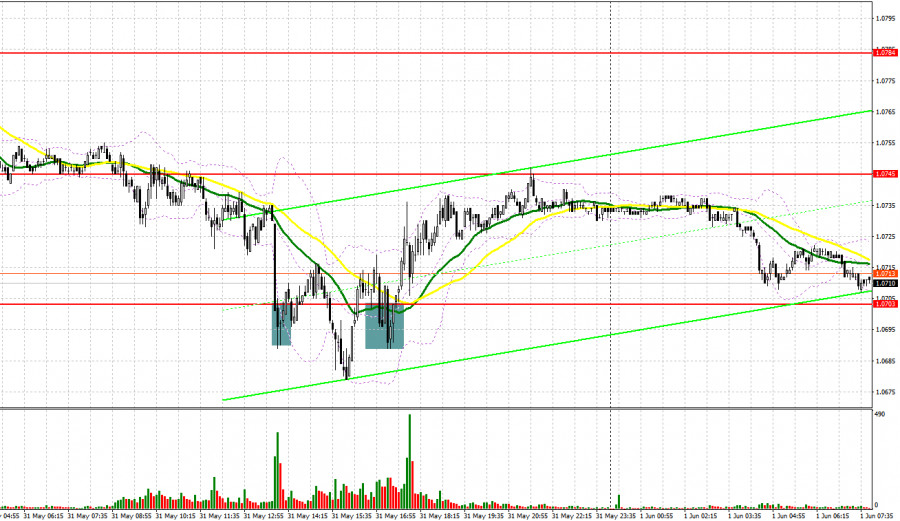

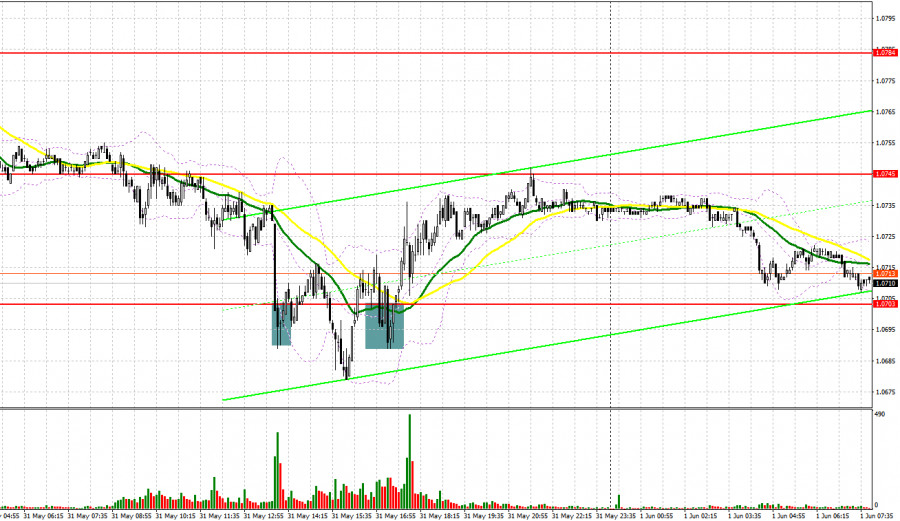

Yesterday, several good and bad market entry signals were formed. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the level of 1.0738 in my morning forecast and advised you to make a decision on entering the market from it. After the first test, the bulls managed to protect the level of 1.0738 and formed a false breakout there, which led to an entry point for long positions. However, there was no major upward movement and after some time the pair returned to the area of 1.0738 again. Then the bears managed to consolidate below this range, and a reverse test from the bottom up led to a signal to open short positions. As a result, the pair collapsed in the area of the next support at 1.0703, which made it possible to take about 30 points of profit. The bulls started to be more active in the afternoon. The first false breakout at 1.0703 did not bring a good result and after moving up by 10 points, the euro was under pressure again. It was only possible to get a signal to buy the euro after returning to this level in the afternoon, but it was rather difficult to interpret it.

When to go long on EUR/USD:

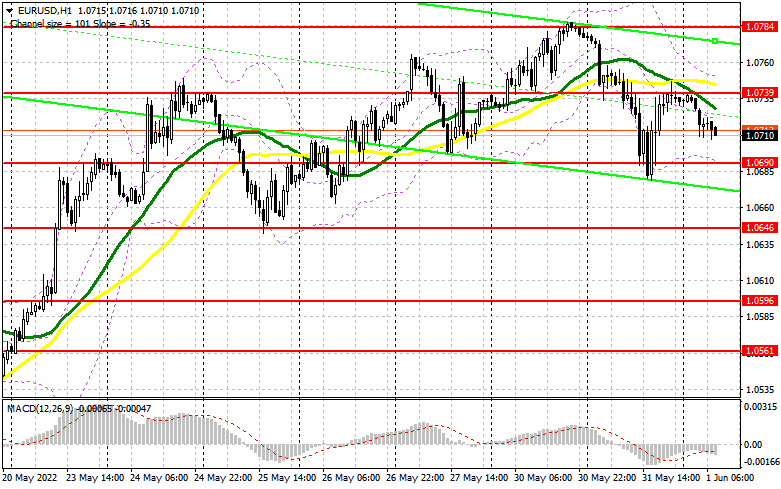

The report on inflation in the euro area did not support the euro, as it is already obvious that with rising prices, the economy will gradually slide into recession - raising rates will only harm, not help. A number of statistics on the eurozone countries will be released today, which will testify to manufacturing activity - a very good indicator that gives an idea of how things are in reality. The German Manufacturing PMI and the Eurozone Manufacturing PMI are due early in the day. I also advise you to pay attention to the eurozone unemployment rate for April this year, although it will have little effect on the market. A decline in production may have a negative impact on the pair, so I advise you to look at long positions only after the decline and a false breakout at the level of 1.0690. Only this will provide a signal to buy the euro in the continuation of the bullish scenario and in the expectation of a return to the intermediate resistance of 1.0739. There are moving averages, playing on the bears' side, which will limit the upward potential.

A breakthrough and test downwards of this range, which may occur during the speech of European Central Bank President Christine Lagarde, forms a new signal for entry into long positions, opening the possibility of updating last month's high in the 1.0784 area. It is unlikely that it will be possible to reach a more distant target in the area of 1.0811 today, but given the bullish trend in the pair, such a scenario cannot be ruled out. If the EUR/USD declines and there are no bulls at 1.0690, the pressure on the euro will seriously increase. Breaking bulls' stops below this level in anticipation of a larger downward correction will push the pair towards 1.0646. The best option for opening long positions would be a false breakout at this level. I advise you to buy EUR/USD immediately on a rebound only from the level of 1.0596, or even lower - in the area of 1.0561 with the goal of an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Bears are trying to take control of the market, and for this they need to defend the nearest resistance at 1.0739 today, but besides this, they need to offer something below 1.0690. Weak statistics for the Eurozone in May, and the data is likely to be worse than economists' forecasts, may help the bears to protect 1.0739. Forming a false breakout there creates the first signal to open short positions against the trend with the prospect of returning to support at 1.0690 – the level formed on the basis of yesterday. A breakdown and consolidation below 1.0690, as well as a reverse test from the bottom up of this range - all this will lead to a sell signal with bulls' stops dismantled and a larger movement of the pair down to the 1.0646 area. There you can think about partial profit taking.

A more distant target will be the area of 1.0596, where I recommend completely leaving short positions. It will be possible to reach this level only in the second half of the day with the strengthening of the bear market. If EUR/USD moves up during the European session, as well as the absence of bears at 1.0739, the situation will again turn in the bulls' direction. In this case, we can talk about the continuation of the upward trend. The best option in this case would be short positions in forming a false breakout n in the area of the last month's high at 1.0784. You can sell EUR/USD immediately on a rebound from 1.0844, or even higher - in the region of 1.0894 with the goal of a downward correction of 30-35 points.

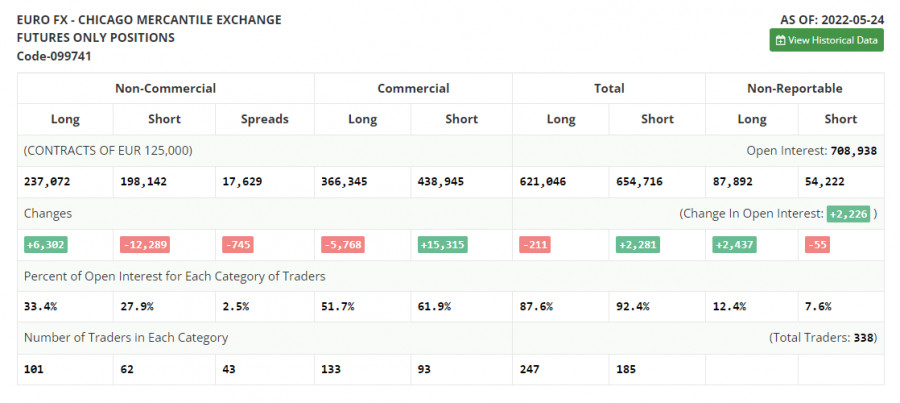

COT report:

The Commitment of Traders (COT) report for May 24 showed that the number of long positions advanced, whereas the number of short positions dropped. Traders continued opening long positions, expecting a more aggressive monetary policy from the ECB. Although last week, there were less comments about a key interest rate hike in the near future, the euro/dollar pair managed to retain its upward potential. Now, analysts suppose that the ECB will raise the deposit rate by one-fourth of a basis point as early as July. The next two hikes will take place in September and December. By the end of the year, the benchmark rate is expected to be at the level of 0.25%. However, some experts are sure that the central bank will have to take more aggressive measures. A lot depends on the inflation report for May of this year. The indicator may jump to 7.7% on a yearly basis, thus increasing pressure on politicians. Against the backdrop, the regulator may raise the key interest rate up to 0.5% from the current zero level.

The COT report unveiled that the number of long non-commercial positions increased by 6,302 to 237,072 from 230,770, while the number of short non-commercial positions declined by 12,289 to 198,142 from 210,431. The euro's low price is making the currency more attractive for mid-term traders. According to the weekly results, the total non-commercial net position increased to 38,930 from 20,339. The weekly close price jumped to 1.0734 from 1.0556.

Indicator signals:

Moving averages

Trading is below the 30 and 50-day moving averages, which indicates a possible continuation of the euro's downward movement.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In the event of a decline, the lower border of the indicator around 1.0690 will act as support. In case of growth, the upper border of the indicator in the area of 1.0745 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.