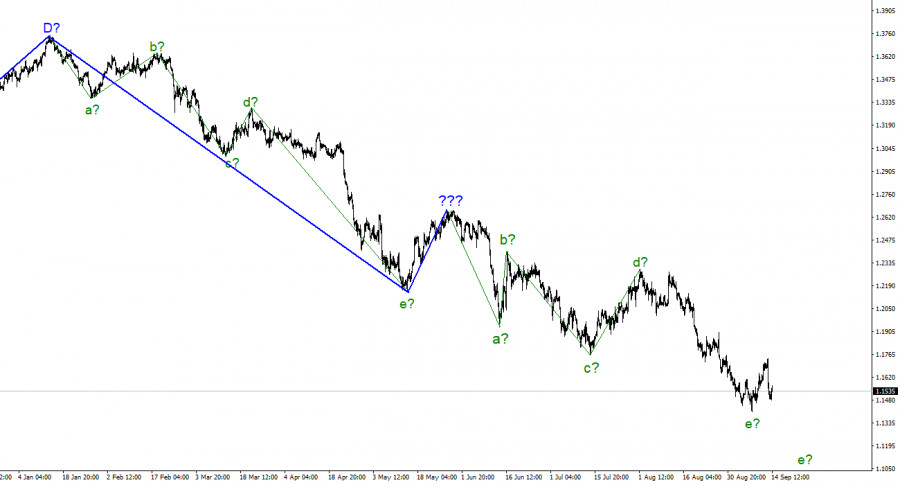

For the pound/dollar instrument, the wave marking at the moment looks quite difficult but does not require any clarification. The upward wave, built between May 13 and May 27, does not fit into the overall wave pattern, but it can still be considered corrective as part of the downward trend section. Thus, we can conclude that the downward trend section continues its construction. At the moment, we have completed waves a, b, c and d, so we can assume that the instrument is inside the e wave. Inside this wave, internal waves are being viewed, and I can assume that wave 4 in e is being built now. If this is the case, the quote decline will resume within wave 5 in e. However, in this case, the wave markings of the euro and the pound will cease to be similar to each other because, with a high degree of probability, the construction of a downward trend section for the euro has been completed. I suggest focusing on the next moment. Wave 4 should not be too strong. An unsuccessful attempt to break through the 161.8% Fibonacci level will mean that this is exactly the correction wave inside e. In this case, we should expect another downward wave in the current section of the trend.

The Bank of England is not going to rush to raise the rate.

The exchange rate of the pound/dollar instrument increased by 50 basis points on September 14 but fell by 190 a day earlier. In the last 24 hours, the market has only discussed inflation in the United States. This is not surprising since yesterday was the key report of the day, and today there were not so many important events to quickly forget about this report. The demand for the British pound has sharply decreased, and today it could decrease even more, as the report on British inflation for the first time in a long time closed with a decrease to 9.9% y/y. As was the case with US inflation yesterday, it isn't easy to interpret this report unambiguously. This morning, the British pound rose a little, but I can't say whether its growth was due to British reports or a pullback after yesterday's fall. One way or another, British inflation interested the markets much less than the American one. Although, by and large, the decline to 9.9% should not change anything in the actions of the Bank of England for the next few months. The Bank of England has raised its interest rate six times in a row, and only now have we seen a slight slowdown in inflation. If it stops now, inflation will start accelerating again very quickly.

Consequently, the Bank of England needs to continue raising the interest rate. As a result: The Bank of England should continue to raise the rate, and the Fed should continue to raise the rate. Nothing has changed after the release of two major reports this week. The market is very interested in the Fed's actions, so the instrument may decline in the coming weeks. But the wave marking is already against such a development of events, so these two types of analysis now conflict.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a continued decline in demand for the pound. I advise now selling a tool with targets near the estimated mark of 1.1112, which equates to 200.0% Fibonacci, for each MACD signal "down," but this mark is quite far away, so the tool may not reach it. Inside the fifth wave, you must sell more carefully since the downward trend section can end at any time. An unsuccessful attempt to break through the 1,1708 mark still keeps the sales option working.

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave that does not fit the current wave pattern, the same five waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.