Buy and sell levels for EUR/USD, October 15. Analysis of yesterday's forex transactions

Analysis of transactions and tips on trading EUR

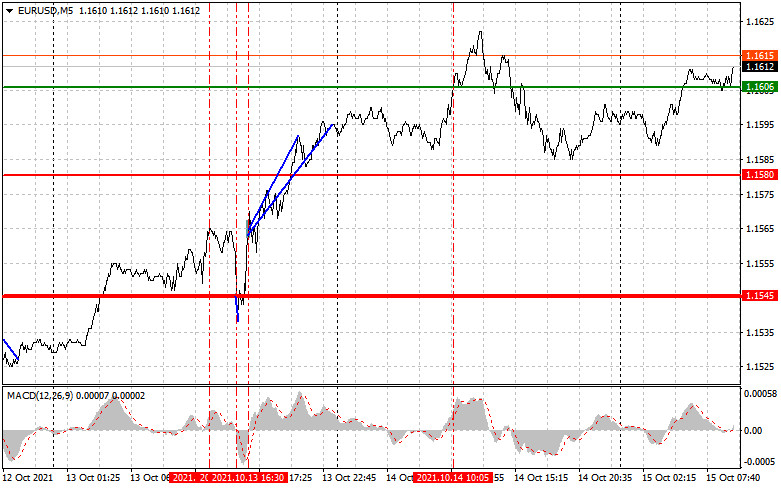

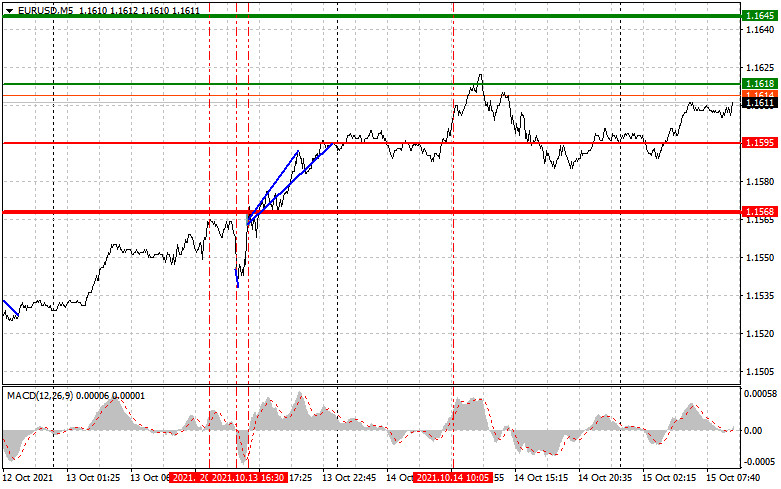

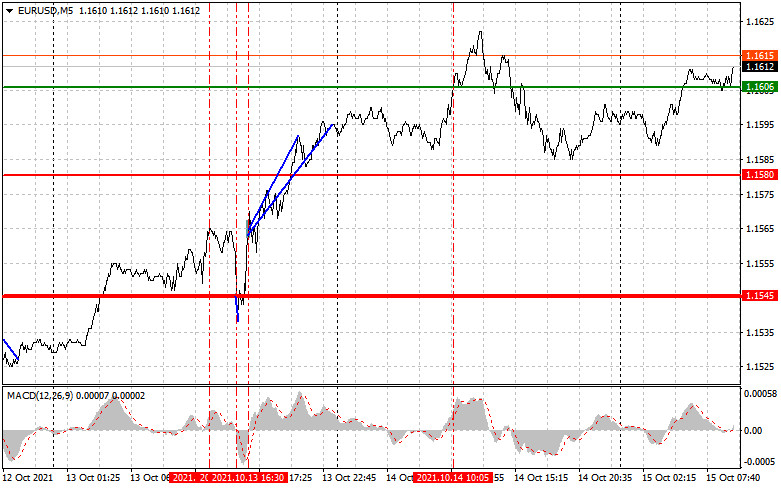

Yesterday, only one entry signal was formed at the price of 1.1606. The entry point is marked on the chart. When the pair was testing the indicated level, the MACD indicator went up significantly from the zero level, which limited the upward movement of the pair. For this reason, I ignored the entry point. No other signal was formed during the day.

The report on Spain's Consumer Price Index did not stir the market as expected. However, ECB members made several statements regarding fears on higher inflation. It helped bulls facilitate the growth of risky assets as well as the EUR/USD pair. The data released in the afternoon on the number of initial jobless claims in the United States surprised economists. The reading exceeded even their expectations, which led to the strengthening of the US dollar against the euro. Today, the economic calendar for the EU contains several important reports: Italy's Consumer Price Index and France's Consumer Price Index. these reports are sure to affect market sentiment. If indicators show an increase in inflation, the euro is likely to rise. Apart from that, the EU is going to unveil its surplus data. Yet, market participants are likely to ignore this report. In the afternoon, investors will be focused on the US retail sales report for September. A sharp decline in the indicator may ease concerns about inflation pressure. if so, the US dollar may dip against the euro. The University of Michigan Consumer Sentiment Index and the speech of FOMC member John Williams are also on traders' radars. These events will take place by the end of the day.

Signal to open long positions

Today, it is recommended to open long positions on the euro when the price reaches 1.1618 (the green line on the chart) with the target level located at 1.1645. If the price rises to 1.1645, it is better to lock in profits and sell the euro immediately in the opposite direction (counting on a movement of 10-15 pips in the opposite direction from the indicated level). The euro may gain momentum only if macroeconomic reports for the EU which are due today turn out to be positive. Important! Before opening long positions, make sure that the MACD indicator is above the zero level and has just bounced off from it.

It would be wise to open long positions on the euro today if the price reaches 1.1595. Yet, at this moment, the MACD indicator should be in the oversold zone, which will limit the pair's downward potential. It may lead to an upward reversal. Growth to the opposite levels of 1.1618 and 1.1645 is also possible.

Signal to open short positions

It is recommended to open short positions on the euro after it touches the level of 1.1595 (the red line on the chart). The target level will be 1.1568. After the price approaches this level, it is better to lock in profits and open long positions on the euro immediately in the opposite direction (counting on a movement of 10-15 pips in the opposite direction from the indicated level). The euro will face pressure in the afternoon if US retail sales data turns out to be positive. Important! Before opening short positions, make sure that the MACD indicator is below the zero level and has just started to decline from it.

It is better to sell the euro today if the price reaches 1.1606. At this moment, the MACD indicator should be in the overbought zone, which will limit the upward potential of the pair and lead to a downward reversal. Analysts expect a decline to the opposite level of 1.1580 and 1.1545.

Description of chart:

The thin green line is the entry price where it is recommended to buy a trading instrument.

The thick green line is the approximate price where one may place a Take Profit order or lock in profits as the price is unlikely to rise above this level.

The thin red line is the entry price where it is recommended to sell a trading instrument.

The thick red line is the approximate price where one may place a Take Profit order or lock in profits as the price is unlikely to decline below this level.

The MACD indicator. When entering the market, it is important to monitor the overbought and oversold zones.

Novice traders need to make very careful decisions when entering the market. Before the release of important macroeconomic reports, it is better to stay out of the market to avoid sharp swings in the exchange rate. If you decide to trade before the release of the crucial macroeconomic reports, then always place Stop Orders to minimize losses. Without placing Stop Orders, you can lose the entire deposit very quickly, especially if you do not use money management, but trade in large volumes.

Remember that for successful trading it is necessary to have a clear trading plan. In this article, there is such. Spontaneous trading decisions based on the current market situation are likely to lead to losses for an intraday trader.