Analysis of EUR/USD and trading tips

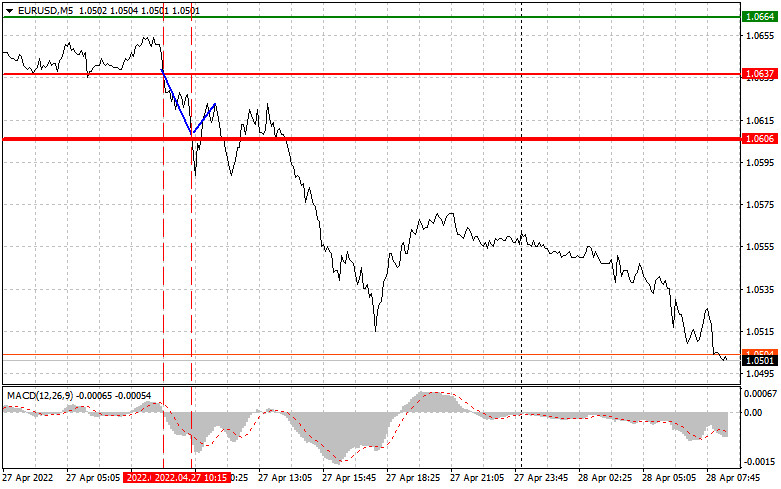

The euro/dollar pair tested the level of 1.0637, when the MACD indicator began falling from the zero level, thus proving the correctness of the entry point. As a result, the trading instrument dropped to 1.0606, where I recommended to close the trade and open the opposite one. The pair lost about 30 pips and then rebounded by 15 pips, following the plan. There were no other trades during the day.

In the first part of the day, the speech provided by Member of the Executive Board of the ECB Philip Lane as well as Germany's consumer climate data put significant pressure on the euro. What is more, the currency continued falling during the US trade since ECB President Lagarde did not say anything new. Notably, the US disclosed weak data on its goods trade balance and pending home sales.

Early today, the eurozone is planning to publish data on its consumer confidence indicator, whereas Germany is going to unveil its CPI report. Both reports will be of primary importance as today, the euro will hardly receive any other support. If data is weak, traders will get a sell signal according to scenario 1. But I still recommend that traders pay attention to comments provided by Vice-President of the ECB Luis de Guindos and the ECB economic bulletin, which will disclose economic forecasts for the near future and provide an assessment of the current situation. In the second part of the day, the US will report its GDP change in the first quarter of the year. The data may stop the US dollar bullish trend. The fact is that economists expect a very sluggish performance. If figures are below the forecast, pressure on the greenback may surge. Against the backdrop, the US unemployment claims figures will have zero effect on the market today.

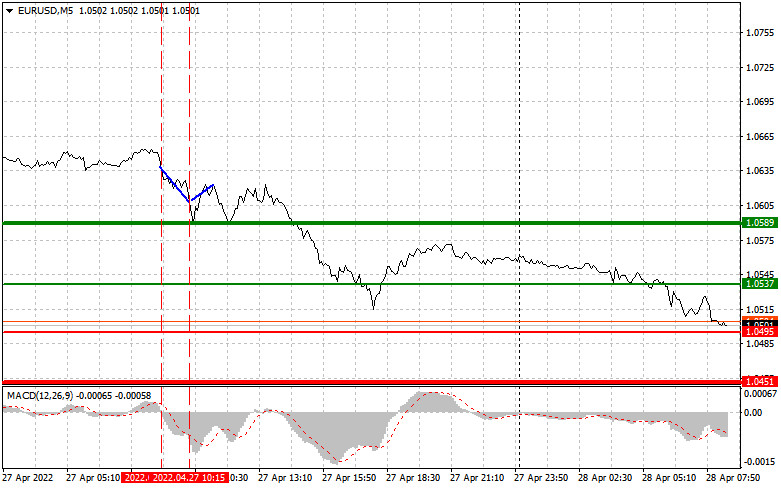

Signals to buy EUR/USD

Scenario 1: today, traders may open buy orders on the euro, if it hits the price of 1.0537 (a green line). The target is located at 1.0589, where it is recommended to close the position and open an opposite order, expecting a drop of 20-25 pips. Today, the euro may rise only in the second part of the day amid weak data on the US GDP. Since the US dollar is extremely overbought, the likelihood of this scenario is very high. Notably, before you start opening buy positions, make sure that the MACD indicator is above the zero level and begins rising from it.

Scenario 2: it is also possible to buy the euro, if it touches the level of 1.0495. At this moment, the MACD indicator should be in the oversold area, thus limiting the downward potential of the pair and causing a reversal. In this case, the pair may climb to 1.0537 and 1.0589.

Signals to sell EUR/USD:

Scenario 1: traders may go short, if the price hits 1.0495 (a red line). The target is located at 1.0451, where it is recommended to close the position and open an opposite one, expecting a change of 20-25 pips. In case of very poor data on Germany's inflation and an active rise in the US GDP in the first quarter of 2022, pressure on the euro will return. Importantly, before you start selling the asset, make sure that the MACD indicator is below the zero line and starts falling from it.

Scenario 2: traders may also open sell orders if the price reaches 1.0537. At this moment, the MACD indicator should be in the overbought area, thus capping the upward potential of the pair and causing a reversal. In this case, the pair may drop to 1.0495 and 1.0451.

What we see on the trading charts:

A thin green line is the entry price at which you can buy a trading instrument.

A thick green line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price will hardly go above this level.A thin red line is the entry price at which you can sell the trading instrument.

A thick red line is the estimated price where you can place a take-profit order or lock in profits by yourself, since the price is unlikely to decline further.

The MACD indicator. When entering the market, it is important to take into account overbought and oversold zones.

Beginning traders should be very cautious when making decisions to enter the market. It is better to open positions ahead of the publication of important reports in order to avoid price fluctuations. If you decide to enter the market amid the news release, place stop orders to minimize losses. Otherwise, you may lose all your funds, especially if you do not use money management and trade big volumes.

Please remember that successful trading requires an accurate trading plan similar to the one described above. Knee-jerk decisions made amid the current market situation is a losing strategy of an intraday trader.