The GBP/USD currency pair was also trading very calmly on Tuesday, below the moving average line. The Heiken Ashi indicator turned up, which indicated a correction. However, once again, we would like to draw the attention of traders to the fact that the pound cannot adjust by more than 500 points within the current downward trend. It may seem that 500 points is quite a lot, but go to the 24-hour timeframe, and everything will become clear. The pound is in approximately the same collapse as the euro currency. If in the first half of the year, a lot was connected with geopolitics, which primarily affects the interests of the European Union and the UK, now a lot is connected with geopolitical consequences. Recall that both the bloc and the Kingdom are on the verge of recession, with no one able to say how strong it can be. The energy crisis and the cost-of-living crisis are the factors that may not give the euro and the pound any chance. Indeed, if you were an international investor, which economy would you choose? The one that is relatively stable and has a sufficient amount of its energy resources or the one that depends on other countries in this matter, with which it is now in a pronounced conflict?

Naturally, the UK government is currently developing various programs to support the population and businesses so that multiple increases in energy prices do not lead to a collapse of the economy. However, it should be understood that any program should be funded from the budget. The more such new programs are implemented, the less money will be left for other, equally important programs. London already makes no secret that any assistance to businesses and households will be financed by loans, which will then have to be repaid. The market does not even react to a fairly strong and rapid increase in the Bank of England rate, although at other times, the pound could show serious growth due to this factor, or at least do so without falling.

The divergence between the BA and Fed rates may worsen this week.

In principle, this week we can only wait for the denouement. No one has any doubt that the Fed will continue to raise the rate at the same pace, and the Bank of England will do it too. If earlier, such a balance of power led only to new falls in the pound, then why should something change now? Of course, both central banks can present surprises. But we believe that the Fed will raise its interest rate by 1.00% rather than the Bank of England by 0.75%. By the way, official forecasts say that the American regulator is preparing to increase by 0.75%, and the British – by 0.5%. If these forecasts come true, the divergence between rates will continue to intensify, which means that the US dollar will receive new grounds for growth.

There is nothing new to say about the comments of the heads of central banks right now. Some traders doubt that Jerome Powell will maintain his hawkish rhetoric after a rather weak inflation report in August. As for his colleague Andrew Bailey, experts have a huge amount of doubt that BA can get inflation under control at all. So far, it is so strong that even six rate increases have not slowed it down. One month doesn't count. Thus, in both cases, it will be about maintaining "hawkish" plans, but the market used to believe more in the Fed and Powell, so it can continue to do so now. Anyway, we believe that until the gap between the BA and the Fed rates begins to narrow, it is pointless to count on strong growth in the pound. Both linear regression channels are directed downwards. The price overcomes the moving from time to time, but this does not lead to a noticeable increase in the pound. Just one US inflation report last week easily broke the nascent growth of the British currency.

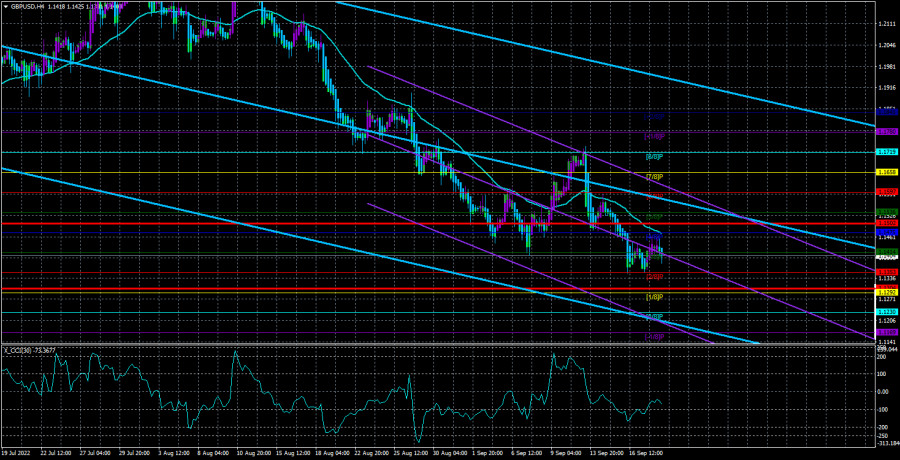

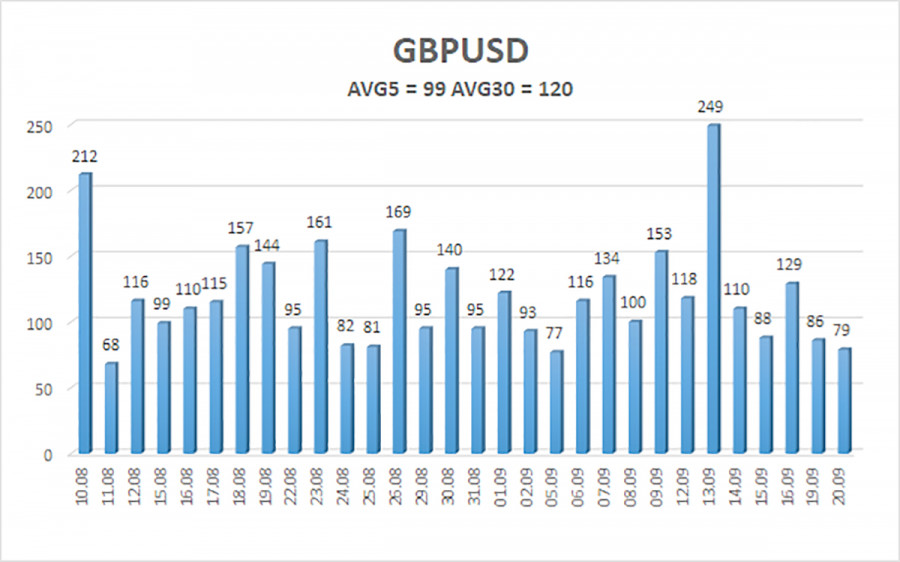

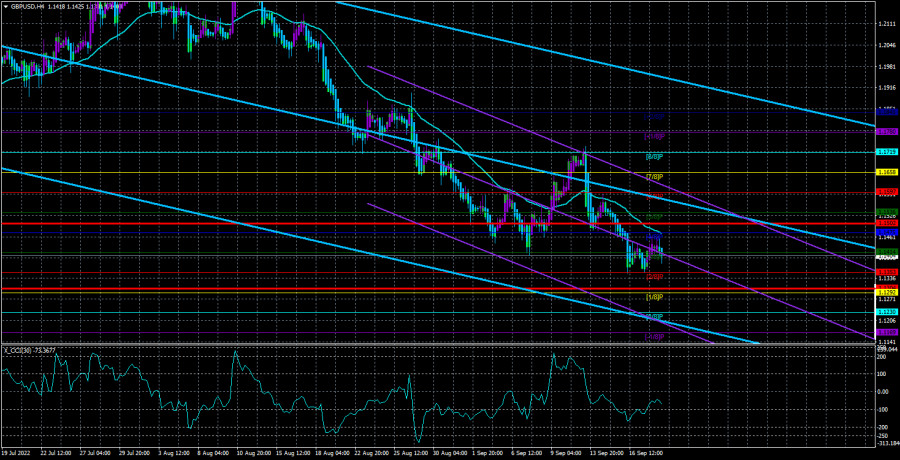

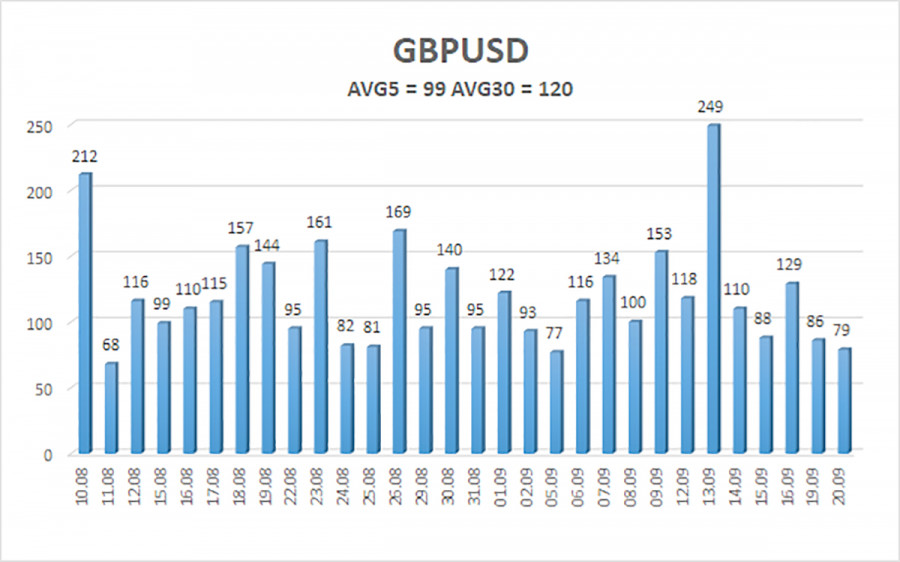

The average volatility of the GBP/USD pair over the last 5 trading days is 99 points. For the pound/dollar pair, this value is "average". On Wednesday, September 21, thus, we expect movement inside the channel, limited by the levels of 1.1304 and 1.1502. The upward reversal of the Heiken Ashi indicator signals a round of upward correction.

Nearest support levels:

S1 – 1.1353

S2 – 1.1292

S3 – 1.1230

Nearest resistance levels:

R1 – 1.1414

R2 – 1.1475

R3 – 1.1536

Trading Recommendations:

The GBP/USD pair continues to remain very low in the 4-hour timeframe. Therefore, at the moment, you should stay in sell orders with targets of 1.1304 and 1.1292 until the Heiken Ashi indicator turns up. Buy orders should be opened when fixed above the moving average with targets of 1.1536 and 1.1597.

Explanations to the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which you should trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.