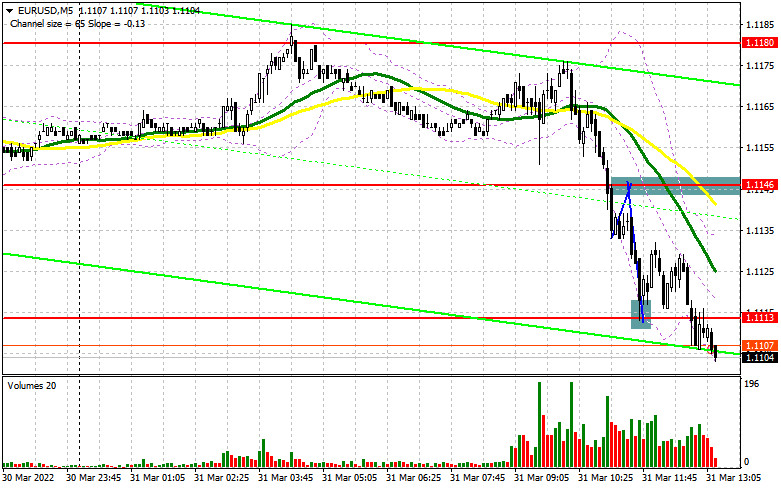

In my morning forecast, I paid attention to the levels of 1.1146 and 1.1113 and recommended making decisions on entering the market. Let's look at the 5-minute chart and figure out what happened. The downward correction of the euro against the background of a rather high overbought was only a matter of time, as I described in detail in the forecast for the first half of the day. Unfortunately, the breakthrough of the 1.1146 level occurred without a reverse test from the bottom up, so I could not get a convenient entry point into short positions. Purchases on a false breakout from 1.1113 did not bring many results, as the pair went up about 20 points, after which the pressure on the euro returned. From a technical point of view, nothing has changed. Only the strategy for the afternoon has changed. And what were the entry points for the pound this morning?

To open long positions on EURUSD, you need:

Rather weak data on the European economy, together with an inflationary jump in the eurozone countries - all this led to a return of pressure on the European currency, which climbed quite high this week. Yesterday's fright, which was seen during Christine Lagarde's speech due to the high level of inflation, clearly does not add optimism to investors against the background of what is happening in the world now. Today in the afternoon, quite important reports on the expenses and incomes of American consumers will be released, as well as weekly figures on the number of initial applications for unemployment benefits in the United States will be published. Strong data will only strengthen the downward correction. If the pair is below the level of 1.1113 and further declines, I advise you to count on buying only after a false breakdown in the area of the next support of 1.1074. But the more important task will be to return and consolidate above 1.1113. This will lead to a false breakout and a good entry point into long positions. A top-down reverse test of this range will also be an additional confirmation of entry into the market. Such a scenario will open a direct road to 1.1146, and there you can reach a large resistance of 1.1180, in which the bulls rested on the results of today. A more distant target will be the 1.1227 level, where I recommend fixing profits. If the pair falls and there are no bulls at 1.1074, and, as we see from the results of the first half of the day, the pressure on the euro is very serious, since buyers quickly take profits, it is best to postpone long positions. The optimal scenario for buying would be a false breakdown of the 1.1035 minimum. It is possible to open long positions on the euro immediately for a rebound only from 1.1005 with the aim of an upward correction of 30-35 points within a day.

To open short positions on EURUSD, you need:

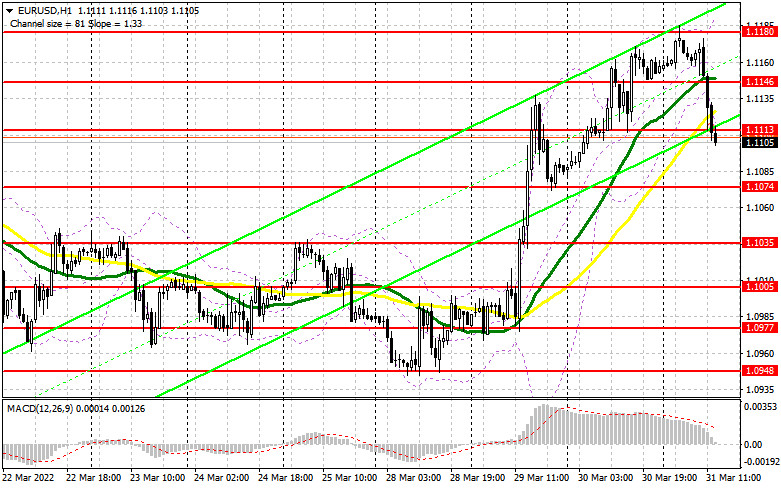

Sellers showed themselves as expected after an unsuccessful attempt by bulls to continue growth against the background of weak statistics on the eurozone. The divergence on the MACD indicator, which I made a separate emphasis on in the morning forecast, also worked out pretty well and, most likely, will continue to work out in the afternoon. And although the market is under the control of buyers, today's statements by FOMC member John Williams may lead to a larger correction of the pair. The primary task of the bears now is to protect the new resistance of 1.1113. The formation of a false breakdown there will lead to the first sell signal, and strong US data and hawkish statements by representatives of the Federal Reserve System will once again remind investors of the strength of the US dollar, which will lead to a decrease in the EUR/USD pair to the area of 1.1074. A breakout and a reverse test of this level will give an additional signal to open short positions already with the prospect of a decline to a minimum of 1.1035. There, buyers should prove themselves at least to build the lower boundary of the new ascending channel. If this does not happen, the 1.1005 area will be a more distant target. In the event of a rise in the euro and the absence of bears at 1.1113, the bulls will again begin to build up long positions in the hope of returning to monthly highs. If there is no one at 1.1113, it is better not to rush with sales. The optimal scenario will be short positions when forming a false breakdown in the area of 1.1146. You can sell EUR/USD immediately for a rebound from 1.1180, or even higher – around 1.1227 with the aim of a downward correction of 20-25 points.

The COT report (Commitment of Traders) for March 22 recorded a reduction in short positions and a sharp increase in long ones. Finding the pair in the area of the next annual lows and large support levels have a positive effect on the euro. However, if you look at the numbers, you can see that the reduction of short positions was minimal. The pressure on the EUR/USD pair has returned after Fed Chairman Jerome Powell abruptly changed his position to a more aggressive one last week. On Monday, the head of the Central Bank said that he expects a 50-point increase in the key interest rate at the next meeting of the committee. A similar number of statements were made by other representatives of the Federal Reserve System, which led to a revision of forecasts by several market participants. The risk of higher inflation in the US is the main reason for such changes in Central Bank policy. However, it is worth remembering that the European Central Bank also held a meeting recently, at which its president Christine Lagarde announced plans to more aggressively curtail measures to support the economy and raise interest rates - this is good for the medium-term prospects of the European currency, which is now heavily oversold against the US dollar. The positive results of the meeting of representatives of Russia and Ukraine and the reduction of the geopolitical conflict will play on the side of buyers of the European currency – this also needs to be taken into account. The COT report indicates that long non-commercial positions increased from the level of 202,040 to the level of 207,051, while short non-commercial positions decreased from the level of 183,246 to the level of 183,208. At the end of the week, the total non-commercial net position increased to 23,843 against 18,794. The weekly closing price increased slightly - from 1.0942 to 1.1016.

Signals of indicators:

Moving averages

Trading is conducted around the 30 and 50 daily moving averages, which indicates an attempt by bears to bring the market back under their control.

Note. The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1.

Bollinger Bands

In the case of growth, the average border of the indicator around 1.1150 will act as resistance.

Description of indicators

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 50. The graph is marked in yellow.

- Moving average (moving average determines the current trend by smoothing out volatility and noise). Period 30. The graph is marked in green.

- MACD indicator (Moving Average Convergence / Divergence - moving average convergence/divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-profit speculative traders, such as individual traders, hedge funds, and large institutions use the futures market for speculative purposes and to meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.