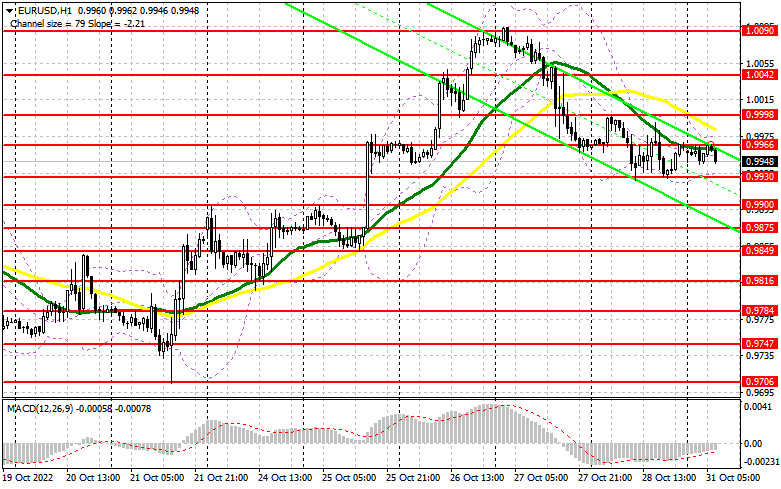

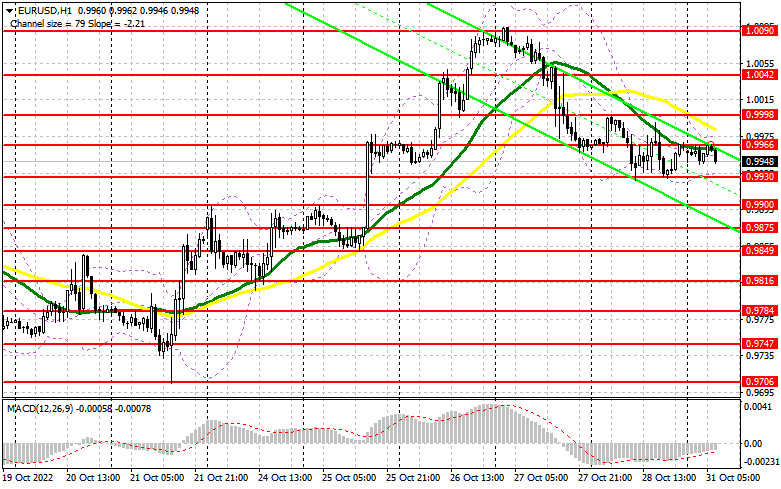

Friday was not a profitable day. Let us take a look at the 5-minute chart to clear up the market situation. Earlier, I asked you to pay attention to the level of 0.9948 to decide when to enter the market. A decline, breakout of this level, and an upward test led to a sell signal. However, the pair did not slide deeper. As a result, traders suffered losses. In the second part of the day, traders failed to receive an entry signal despite the fact that the price was repeatedly touching 0.9959.

Conditions for opening long positions on EUR/USD:

The end of the month is expected to be rich in events. The eurozone is planning to publish a bulk of information that is expected to boost volatility and determine the pair's direction early this week. Germany will disclose its retail sales report for September, which may show a decline, as well as the CPI and GDP data. The economic contraction to 1.0% will seriously damage the euro that has just gained momentum. If the euro/dollar pair drops amid the news about the eurozone inflation that surpassed 10.0%, only a false breakout of the nearest support level of 0.9930 will give a perfect long signal with the target at 0.10000. Bulls will have a chance to gain control over the market, if the price breaks this level and downwardly tests it. If the reports are disappointing, almost nothing will make traders buy the euro. A breakout of 1.0000 will affect bears' stop orders and give an additional buy signal with the target at 1.0042, which will intensify the bullish trend. A break above 1.0042 will give a reason to increase to the weekly high of 1.0090, where it is recommended to lock in profits. If the pair drops and buyers fail to protect 0.9930, pressure on the euro will surge, thus causing another slump. In this case, it will be wise to go long after a false breakout of 0.9900. It is also possible to buy the asset just after a bounce off 0.9875 or lower – from 1.9849, expecting a rise of 30-35 pips.

Conditions for opening short positions on EUR/USD:

On Friday, bears failed to push the price below 0.9930. However, they may do this today after the publication of Germany's retail sales figures. Today, bears should primarily protect the resistance level of 1.0000. It will be better to open short orders after a false breakout of this level amid Germany's data. This will give a perfect entry point and allow the price to return to 0.9930. If the pair settles below this level and upwardly tests it, traders may go short to push the price to 0.9900, where sellers may face serious obstacles. The farthest target is located at 0.9875, where it is recommended to lock in profits. If the euro/dollar pair increased during the European session and bears fail to protect 1.0000, demand for the pair will jump, thus prolonging the uptrend. In this case, sellers should remain cautious. They may open orders after a false breakout of 1.0042. It is also possible to go short after a rebound from the monthly high of 1.0090 or higher – from 1.0136, expecting a decline of 30-35 pips.

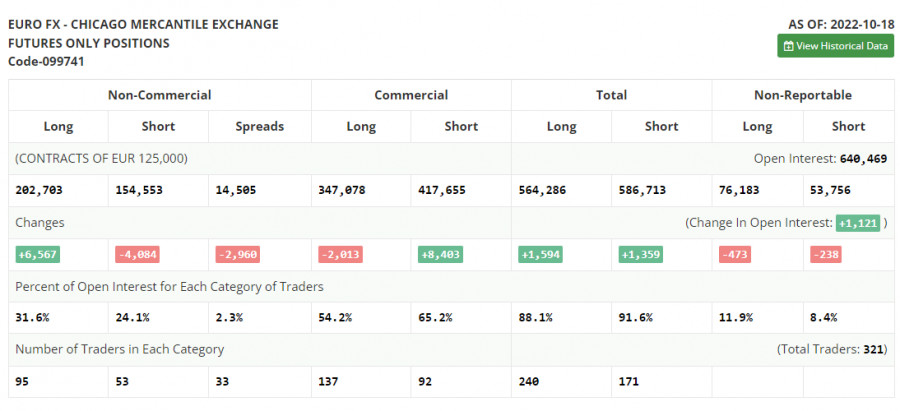

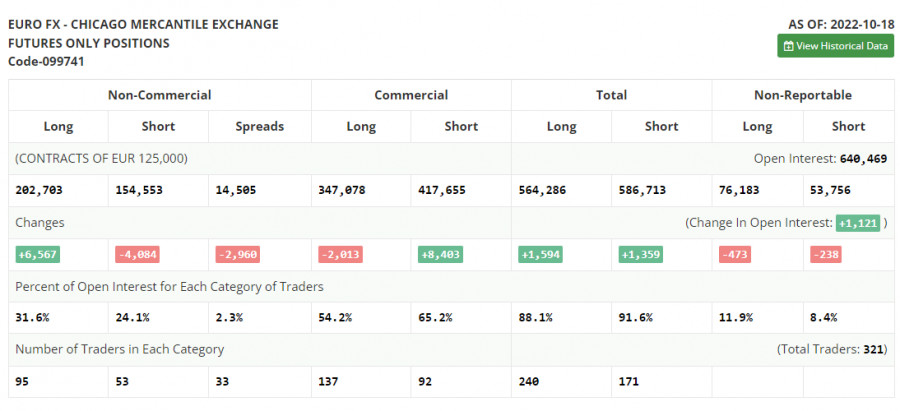

COT report

According to the COT report from October 18, the number of both long and short positions slumped. Demand for the US dollar is falling amid more and more signs of the economic recession caused by extremely aggressive monetary policy tightening conducted by the Federal Reserve. Last week, it became known that the housing market continued falling. This week, the US reported a significantly lower business activity in the services sector. This will hardly support the greenback since the demand for the euro is rapidly rising amid the ECB's promises to continue its hawkish policy to curb surging inflation. Notably, in September, the eurozone inflation slackened and remained below 10.0%. The COT report unveiled that the number of long non-commercial positions increased by 6,567 to 202,703, while the number of short non-commercial positions decreased by 4,084 to 154,553. At the end of the week, the total non-commercial net position remained positive at 48,150 against 37,499 a week earlier. This indicates that investors are benefiting from the situation and continue to buy the cheap euro below parity. They are also accumulating long positions supposing that the crisis will end soon and the pair will recover in the long term. The weekly closing price rose to 0.9895 from 0.9757.

Signals of indicators:

Moving Averages

Trading is performed below the 30- and 50-day moving averages, which shows that the pair is still under pressure.

Note: The period and prices of moving averages are considered by the author on the one-hour chart, which differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If the euro/dollar pair rises, the upper limit of the indicator located at 0.9975 will act as resistance. If the pair drops, the lower limit of the indicator will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing volatility and noise). The period is 30. It is marked in green on the graph.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages). A fast EMA period is 12. A slow EMA period is 26. The SMA period is 9.

- Bollinger Bands. The period is 20.

- Non-profit speculative traders are individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions are the total number of long positions opened by non-commercial traders.

- Short non-commercial positions are the total number of short positions opened by non-commercial traders.

- The total non-commercial net position is a difference in the number of short and long positions opened by non-commercial traders.