Bitcoin has been under significant pressure from sellers for the past week. The cryptocurrency made several false breakouts of the $23k and $23.4k levels, after which bearish pressure increased, and the asset declined to the $22.8k–$22.9k support zone.

The S&P 500 index and other stock indices showed a similar movement. The fundamental background was also replete with worrying signals, which foreshadowed the corrective movement of BTC. Among the latest important news is the speech of Federal Reserve Chairman Jerome Powell regarding the U.S. monetary policy.

Powell's theses and their impact on the market

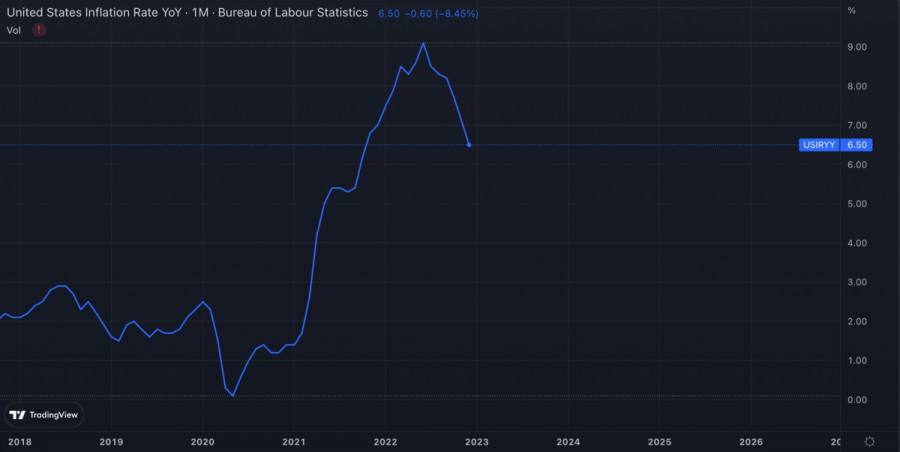

Powell's speech left the markets with mixed feelings, as what he said gives hope for improvement in the situation, but at the same time, leads to possible excesses. However, in spite of everything, the main signal for the markets was his statement that 2023 will be a year of strong deflationary movement.

Powell noted that the decline in inflation began due to lower energy prices and the Fed's tight policies. At the same time, the official notes that the boundary level of acceptable rate hikes and balance sheet cuts has still to be reached.

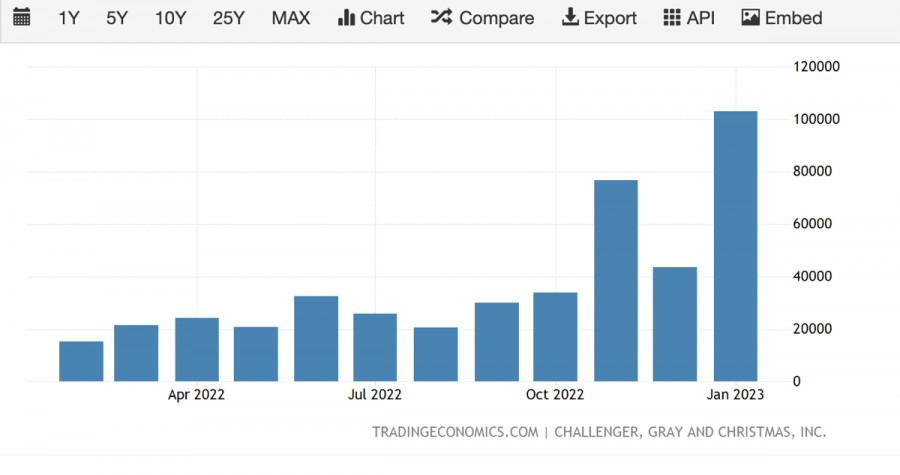

The Fed chairman confirmed the market's worries about the strong labor market and said that the regulator did not expect such sustainability. As such, Powell conceded that the boundary level of the key rate could be revised upward.

In other words, a strong labor market has played a cruel joke on the financial markets, and now we should expect a prolongation of the current Fed policy. That could mean a rate hike through the summer of 2023 and, accordingly, a shift in the likely start of monetary policy easing.

As a result, JPMorgan analysts predict a 0.5% increase in the key rate in March if about 500,000 jobs appear in the next jobs report. Given this, it is definitely not worth expecting monetary policy easing in the first half of 2023.

Bitcoin and stock markets

Conflicting signals are coming from stock markets and leading financial institutions. Goldman Sachs analysts have raised the S&P 500's three-month target from $3,600 to $4,000, indicating an improvement in the macroeconomic situation and an increase in investment engagement.

Bank of America updated its forecast for global economic growth in 2023 from 2.2% to 2.5%. However, at the same time, Bank of America CEO Brian Moynihan believes that a default on U.S. foreign debts is possible this year, which alarmed investors.

Meanwhile, the correlation between Bitcoin and SPX remains high. This confirms the dependence of the crypto market on the situation on the stock market and the global economy.

BTC/USD Analysis

According to Santiment, the crowd's involvement in what is happening in the crypto market remains at a high level. This is a positive signal indicating continued interest in assets and a high level of investment activity.

In recent days, the bears have been trying to push BTC below $22.8k–$22.9k. At some point, the price did drop to $22.6k, but subsequently the bulls managed to defend the main consolidation corridor.

The formation of a large green bullish engulfing candle ends the possibility of a downward movement in the coming days. The price of BTC again consolidated above $23k, but the probability of the continuation of the upward movement is low.

In the coming days, Bitcoin will spend in consolidation as the market continues to take profits, and another upward spurt of BTC contributes to this. Technical indicators fell to acceptable levels around the 50–60 mark, which means that we can no longer talk about overheating.

Results

In the coming days, Bitcoin will hold a consolidation within the $22.8k–$23.4k range. It is not worth expecting strong impulsive price movements until next week, on the announcement of inflation data for January.

This event will likely become a key factor in the new stage of the upward movement of the cryptocurrency. Among the possible targets are the $24.2k–$24.4k levels, and a move towards $24.8k–$25k. However, these targets should be considered in the paradigm of a 2-3 week price movement.