While the euro and the British pound continue to experience serious problems with further growth against the US dollar, expecting further aggressive actions from the Federal Reserve System to tighten monetary policy, World Bank Chief economist Carmen Reinhart said that the world economy is experiencing a period of "exceptional uncertainty", adding that she admits a further reduction in growth forecasts.

Most recently, in its report, the World Bank lowered its estimate of global growth in 2022 to 3.2% against the January forecast of 4.1%. This happened directly due to a decrease in the forecast for Europe and Central Asia, including Russia and Ukraine. "I think it's clear to everyone - the risks have increased significantly and are quite significant," Reinhart said in an interview. According to her, there are enough reasons for a negative assessment of the economy - from quarantine in China due to COVID to high inflation in the eurozone countries, as well as the conflict in Ukraine.

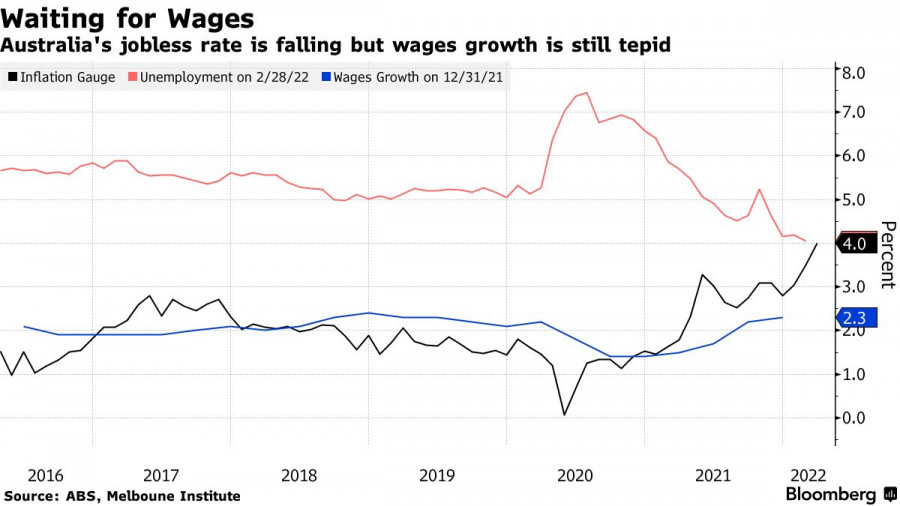

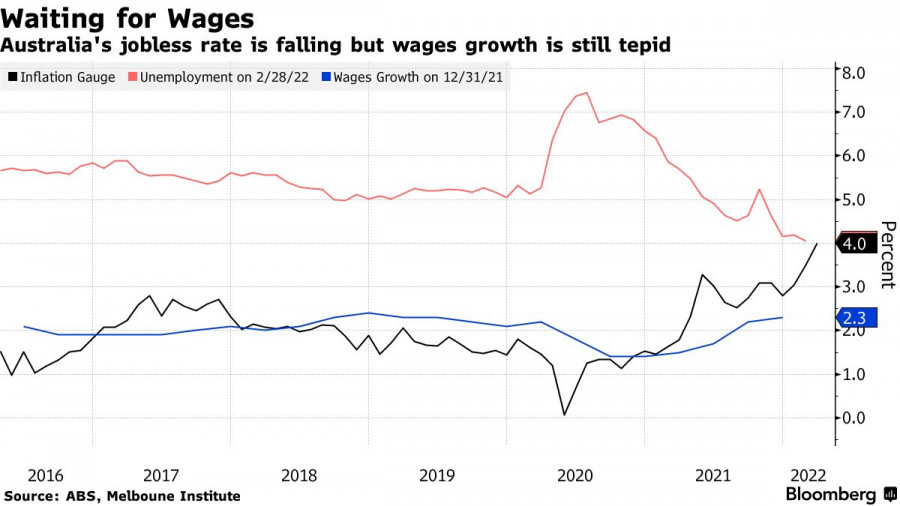

The Reserve Bank of Australia also recently gave a negative assessment of fast-growing inflation, which is stimulated not only by a jump in prices but also by accelerating wage growth. In its minutes of the April monetary policy meeting, the Central Bank of Australia said that annual core inflation in the first three months of this year is likely to exceed its target level of 2-3%. Politicians also noted that wage growth has accelerated, which creates additional problems to maintain the target level. "Current events have brought the likely timing of the first interest rate hike closer," the RBA said. "In the coming months, we will receive important additional data on inflation, as well as on how wages are growing." Most likely, based on these data, politicians will decide on changing interest rates. Immediately after this news, the Australian dollar significantly strengthened its position, and the yield of three-year government bonds increased.

The shift even in Australia reflects the hawkish turn of central banks around the world as they try to stop the rise in consumer prices that occurred as a result of significant economic stimulus during the pandemic, as well as Russia's military special operation on the territory of Ukraine. Last Thursday, South Korea and Singapore tightened their monetary policy, and a day earlier, rates were raised in Canada and New Zealand.

As for the Reserve Bank of New Zealand, as I noted above, it has also decided to tighten monetary policy and expects to continue raising rates in the coming quarters. The reason is the same desire to contain inflation expectations. "We acted quite aggressively, which led to a tightening of monetary conditions," Orr said. "We have also provided pretty convincing forecasts about the future of our economy and expect further rate hikes in the coming quarters." Let me remind you that last week the RBNZ demonstrated the largest interest rate increase in 22 years, raising the official interest rate by half a percent, to 1.5%.

According to the latest data, inflation in New Zealand peaked in three decades at 5.9% in the fourth quarter of 2021, and this week's report could show an increase to 7.1% in the first three months of 2022.

Serious changes in the policy of central banks of different countries harm risky assets, which continue to lose their positions against the US dollar. Most likely, this week representatives of the Federal Reserve System will continue to tell us about plans for a more aggressive approach to monetary policy and how they seriously intend to fight the highest inflation in the last 40 years - this is a strong signal for further growth of the US dollar. Let me remind you that, according to the latest data, the consumer price index in the United States jumped to 8.6% per annum in March.

As for the technical picture of the EURUSD pair

The euro has failed to demonstrate anything interesting. As a result, the pressure on the trading instrument remains, and it is very early to talk about the prospects of its correction. The worsening of geopolitical tensions due to Ukraine's refusal to negotiate forces Russia to act more aggressively again, which does not add confidence in the future and restrains demand for risky assets. Given the aggressiveness of the Fed's policy, it is best to bet on further strengthening of the dollar. To return the market under their control, euro buyers need a break above 1.0810, which will allow them to build a correction to the highs of 1.0850 and 1.0885. In case of a decline in the trading instrument, buyers will be able to count on support in the area of 1.0760. Its breakdown will quickly push the trading instrument to the lows of 1.0710 and 1.0640.

As for the technical picture of the GBPUSD pair

Everyone has already forgotten about the growth of the British pound last week. As a result of the increased pressure, the pair lost everything that it managed to take away, and now everyone is waiting for the monthly lows to be updated - quite a lot will depend on the behavior of buyers there. Buyers of risky assets need to focus properly on the breakdown and consolidation above the resistance of 1.3020. Going beyond this range will lead to a resumption of correction and will allow updating new local highs in the areas of 1.3045 and 1.3070. When the pressure on the trading instrument returns, most likely, buyers will prefer to act more actively around 1.2990, but their appearance is not excluded only in the 1.2950 area. Larger support is seen around 1.2910.