When to go long on GBP/USD:

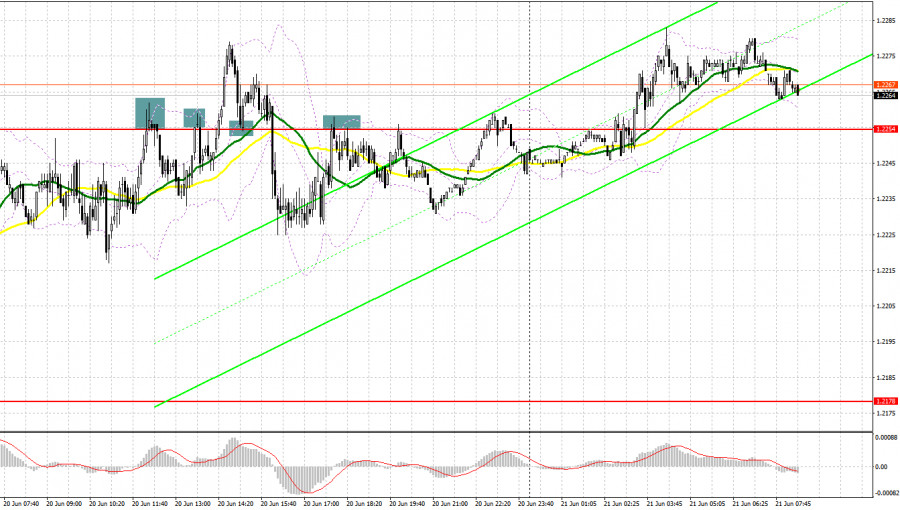

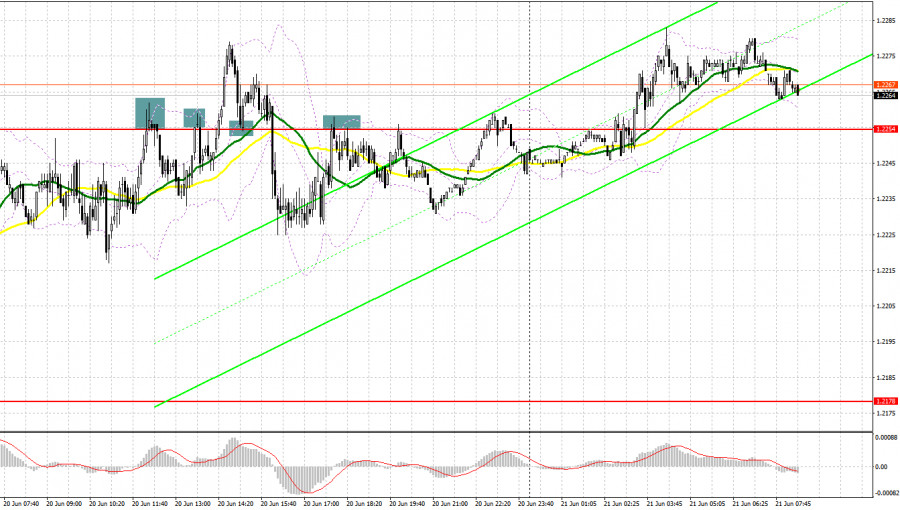

Several good market entry signals were formed yesterday. Let's take a look at the 5-minute chart and see what happened. I paid attention to 1.2245 in my morning forecast and advised making decisions from it. Failure to return above 1.2254 resulted in forming a false breakout, which in turn gave signals to sell the pound. However, all that the bears managed to do was to pull down the GBP/USD by 20 points. We did not reach the key target around 1.2178, after which the demand for the pound returned. The bulls achieved a breakthrough and reverse test from top to bottom of 1.2178 in the afternoon. It seems like there was hope for growth, but after moving up by 15, the pressure on the pound returned. Another consolidation below 1.2178 and a reverse test along with a sell signal brought about 20 points of profit and that was it.

COT report:

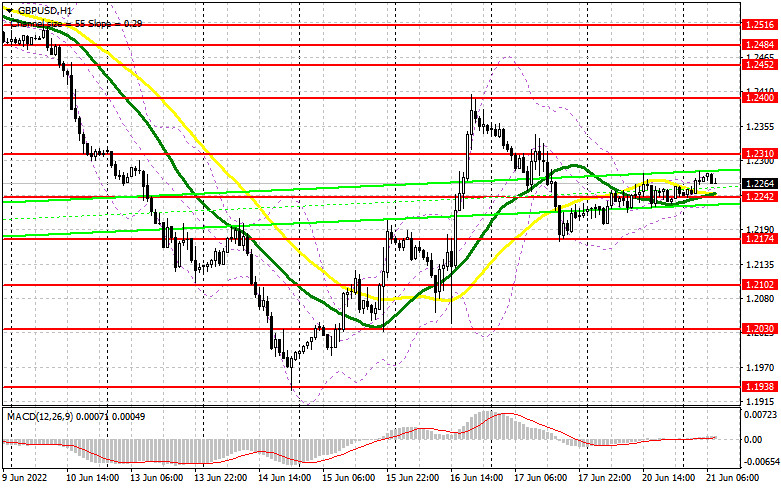

Before analyzing the technical picture of the pound, let's look at what happened in the futures market. The Commitment of Traders (COT) report for June 14 logged a reduction in both long and short positions, which led to a slight decrease in the negative delta. After the Bank of England meeting, which announced the adherence to the previous plan to raise interest rates and fight high inflation, the pound strengthened its position, which will affect future COT reports. Surely the big players are taking advantage of the moment and buying back the heavily depreciated pound, despite all the negative that is happening to the UK economy right now. However, one should not count on the recovery of the pair in the near future, as the policy of the Federal Reserve will seriously help the US dollar in the fight against risky assets. The COT report indicated that long non-commercial positions decreased by 5,275 to 29,343, while short non-commercial positions decreased by 10,489 to 94,939. level -65 596. The weekly closing price decreased and amounted to 1.1991 against 1.2587.

Today there are no statistics on the UK, which will support the pound, provided that the bulls will be able to protect the nearest level of 1.2242 in the first half of the day. Moving averages, playing on the bulls' side, also pass on it, which adds special importance to the level. Only a false breakout there will give a signal to buy, which can keep the GBP/USD within the corrective ascending channel, counting on a return to 1.2310. Consolidation above this range and a reverse test from top to bottom will give a signal to buy in order to bring back the pair to a rather large resistance area of 1.2400. Bulls will obviously take a break in that area.

A more distant target will be the area of 1.2452, where I recommend taking profits. In case the pound falls during the European session and the lack of activity at 1.2242, in my opinion, this will add serious problems to the bulls, since the "sluggish" correction that we have been seeing since the end of Friday last week will end. In this case, I advise you to postpone long positions until the support of 1.2174. Forming a false breakout there will give an entry point into long positions, counting on maintaining the pair at least in the horizontal channel. You can buy GBP/USD immediately on a rebound from 1.2102, or even lower - around 1.2030 with the goal of correcting 30-35 points within the day.

When to go short on GBP/USD:

Although the bears are not active, everything is going in their favor so far. There is no serious growth in the continuation of the bull market that we observed last Thursday - this indicates that the speculators have run out of steam and now everything can return to the bears' control. Absence of bulls below 1.2242 could lead to a continuation of the bear market and a bigger fall for the pair. Of course, the best option for opening short positions today would be forming a false breakout at 1.2310, which was formed following last week's results. This will provide an entry point for the pair to fall and break through support at 1.2242. A bigger struggle will unfold for this level, as the bulls will try to build the lower border of the new upward corrective channel there. Only a breakdown and reverse test of this level from below will bring the GBP/USD down to a low like 1.2174, leaving a good opportunity to update support at 1.2102.

A more distant target will be the area of 1.2030, where I recommend taking profits. If the pair grows during the European session and there are no bears at 1.2310, the bears may lose the initiative. In this case, I advise you to postpone short positions until 1.2400. I advise you to sell the pound there only after a false breakout. You can open short positions immediately for a rebound from the high of 1.2452, or even higher - from 1.2484, based on the correction of the pair down by 30-35 points within the day.

I recommend to read:

Indicator signals:

Moving averages

Trading is conducted just above 30 and 50 moving averages, which indicates the bulls' attempt to resume the pair's growth.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.2230 will increase pressure on the pair. If the pair grows, the upper border of the indicator around 1.2300 will act as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.