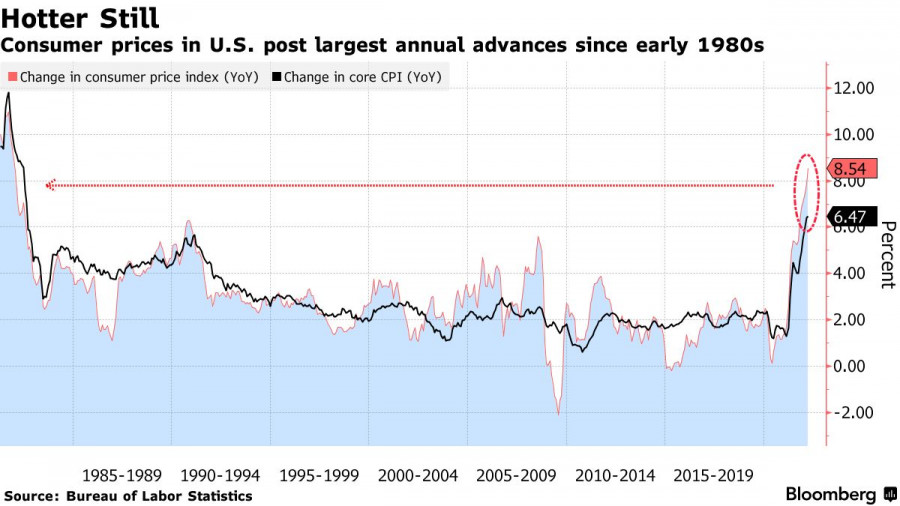

The US dollar slowly but surely continued to strengthen its position against a number of risky assets - especially against the European currency and the British pound after it became known yesterday that consumer prices in the US rose in March to the highest level since the end of 1981. This indicates a painfully high cost of living in the United States and increases pressure on the Federal Reserve to raise interest rates even more aggressively.

A similar situation is happening in many other countries, but it is in the United States that this leads not only to a likely recession, but also strengthens the political split, which can lead to the Democrats losing the Senate and losing the midterm elections. According to the US Department of Labor, the consumer price index rose to 8.5% compared to last year in March, after jumping to 7.9% in February. The widely used inflation indicator increased by 1.2% compared to the previous month, which was the largest increase since 2005. Half of the monthly growth was provided by gasoline costs, but it is expected that food prices also made a serious contribution to the indicator. Economists had forecast CPI growth to 8.4% per annum and 1.2% compared to February. And although many economists consider March to be the peak of the current inflationary period, however, the geopolitical situation forces us to adhere to a different opinion. The increase in energy prices is clearly not final, especially given the ongoing military special operation of Russia on the territory of Ukraine. However, it would be ridiculous to blame Russia for high energy prices in the United States, as the Democrats tried to do, as well as American President Joe Biden.

High prices have long been a major headache for Americans after the largest economic stimulus program lasting more than two years during the coronavirus pandemic. The Fed has no choice but to raise interest rates more aggressively, as politicians announced earlier this month. A sharp inflationary jump opened the door for an interest rate hike of half a percent already at the May meeting of the committee, as inflation is unlikely to fall to the central bank's 2% target in the near future. Do not forget that China has gone into deep isolation after another outbreak of Covid-19, and the increase in demand only exacerbates problems in supply chains.

More recently, Chinese Premier Li Keqiang issued a warning about possible risks to economic growth. This indicates increased concern about the prospects for further GDP recovery, as large-scale restrictions and blockages due to Covid disrupt production and supply chains, which leads to unforeseen costs and expenses. According to the politician, China will study and adopt a softer economic policy as necessary to support the economy.

As for US President Joe Biden, as I noted above, he was criticized for not being able to curb prices, since ordinary Americans now have to pay exorbitantly high prices for fuel and food. Inflation more broadly will complicate Democrats' efforts to maintain their small margin in the midterm elections later this year. At the same time, the risks are growing that high consumer prices will lead the economy to recession. A growing chorus of economists predicts that economic activity will shrink quite significantly in the near future, as consumers will reduce their spending in response to higher prices. The Fed's abrupt intervention in its monetary policy in an effort to catch up will also be a serious blow to the economy - the rising cost of borrowing has never helped to cope with the crisis.

Core inflation, excluding volatile categories in the form of energy and food, increased by 0.3% compared to the previous month and by 6.5% compared to last year. This is less than predicted. The cost of services has also increased. So the average increase is 5.1% compared to last year – this is the biggest jump since 1991.

According to forecasts of a number of economists, by the end of the year inflation will fall to the level of 6%, which will continue to put pressure on the US central bank and Fed Chairman Jerome Powell. As I noted above, the central bank is expected to raise interest rates by half a point at its next meeting in May — and possibly at one or more meetings after that. However, the second increase will not occur before the Fed's balance sheet begins to shrink.

The fact that wage growth does not keep up with prices only adds fuel to the fire. Even though employers are raising wages to attract and retain workers, inflation is eating up a significant portion of Americans' incomes. The average hourly wage adjusted for inflation in March decreased by 2.7% compared to a year earlier, which was the 12th consecutive decline.

As for the technical picture of the EUR/USD pair

The geopolitical tension around Russia and Ukraine has again grown to a rather serious level, as Kiev is clearly delaying negotiations. Given the aggressiveness of the Fed's policy, it is best to bet on further strengthening of the dollar. To return the market under their control, euro bulls need a break above 1.0930, which will allow them to build a correction to the highs: 1.0970 and 1.1010. In the event of a decline in the trading instrument, bulls will be able to count on support around 1.0840, as it was at the end of last week. Its breakdown will quickly push the trading instrument to the lows: 1.0810 and 1.0770.

But such problems are not only found in the US. Yesterday it became known that the rapid rise in the cost of living deprives the Brits of the advantages of a strong labor market. Yes, it may seem joyful to everyone that unemployment has fallen to 3.8% in three months – the lowest level since the end of 2019. The number of vacancies in March this year rose to a new record of almost 1.28 million people, reflecting an acute shortage of jobs. However, all this does not help the British to earn, as high inflation, the cost of services and utilities, along with fuel prices, eat up the lion's share of their income. Nevertheless, as some experts note, the observed acceleration in wage growth is likely to be enough to convince the Bank of England to raise interest rates again in May this year. But despite the growth of the labor market, the constant shortage of qualified specialists and labor, along with rising costs, create an additional burden on households, forcing employers to raise salaries in order to find the right employees, which further fuels inflation.

As for the technical picture of the GBP/USD pair

The pound has failed the lower boundary of the horizontal channel and continues the bearish trend. Bulls need to think about how to return the resistance to 1.3040. A breakthrough in this range will open the way to 1.3105 and then to 1.3140. If the bears manage to surpass 1.2990, you can safely catch the pound in the area of 1.2950 and 1.2910. So far, nothing indicates that bulls will actively fight for the market even at current lows. The recently released data on the UK economy proved this once again.