The EUR/USD currency pair collapsed by almost 200 points on Tuesday and remained below the moving average line on Wednesday. Thus, a rather promising technical picture, which suggests further growth of the European currency, is still considered irrelevant. But we once again saw the inability of the euro to adjust by more than 400 points. What's next? Currently, the euro currency is located below the moving average, which means that the probability of a new pair falling is increasing with the update of 20-year lows, to which no more than 100 points remain to be passed. However, we would like to draw the traders' attention to the fact that the market was trading on momentum on Tuesday. A one-way movement of almost 200 points due to one report, the value of which was not shocking or discouraging, can hardly be considered an adequate reaction. Thus, we believe that the euro currency may well switch to a new "swing" mode in the near future.

The fact that the Fed will continue to raise the key rate is no secret to anyone. Even if inflation had fallen more than the August report showed, it would not have changed anything in the state of things. Thus, there may be no further strengthening of the US currency since the divergence between the ECB and Fed rates promises to level off soon. There is a situation where the probability of further decline/growth of the euro is 50-50. The euro currency has been falling for too long and is clearly oversold now. The ECB is ready to aggressively raise the rate, which also works in the hands of the euro currency. But at the same time, the global downtrend persists, and both linear regression channels are still directed downward. Therefore, in the coming days and weeks, you need to be prepared for any development of events and pay increased attention to technical analysis.

Inflation is the most difficult indicator to predict.

Even before yesterday's publication of American inflation, we said it was not worth opening champagne ahead of time about its slowdown. Recall that in May, the consumer price index was already slowing down by a couple of tenths of a point, after which it resumed acceleration. About the same thing we are seeing now. After inflation slowed significantly in July, the slowdown was only 0.2% in August. At this rate, this indicator will return to its target of 2% in several years.

Consequently, the Fed has no other option but to raise the key rate. And the faster they do it, the faster inflation will return to the target value. Inflation is such an indicator that it is influenced by monetary policy. A huge number of factors should be taken into account when forecasting. That is why we have always said that in the case of inflation, it is not the value of a single report that is important but the trend. If the indicator has been moving in one direction for several months, you can output the average value by which it changes in one month.

So far, we have a decrease of 0.6% and a decrease of 0.2%, with a general increase in the key rate to 2.5%. For one month, the consumer price index slowed down by 0.4%. But who said that this was only the merit of the Fed? Maybe other factors played a role? We want to say that a further rapid fall in inflation, even with further tightening of the Fed's monetary policy, is far from obvious. Many experts say that the problem of high inflation has been a problem for many years. Inflation has been rising for more than a year after the Fed poured huge amounts of money into the economy out of nowhere during the two years of the pandemic. The QT program is already working, thanks to which about $95 billion is withdrawn from the economy every month. But "to break is not to build." If inflation rises to its maximum value for about a year, it will take two years to return to its original position. And this is provided that there are no new economic shocks and "waves" of the pandemic, along with "lockdowns."

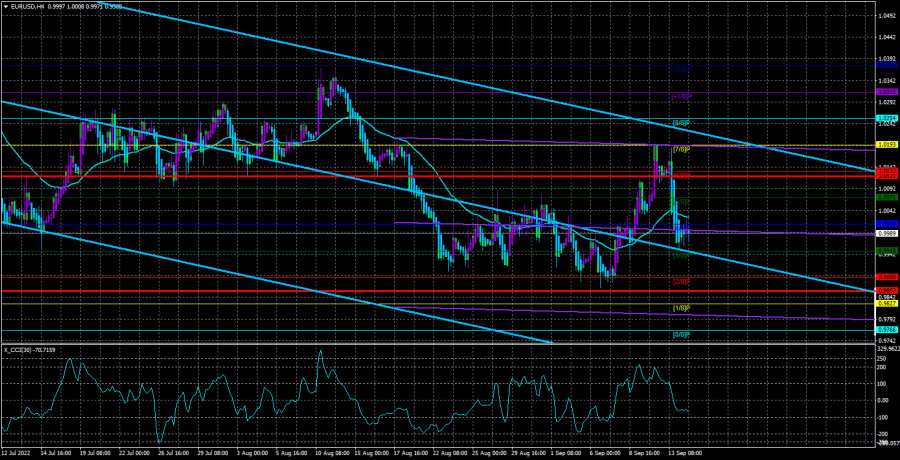

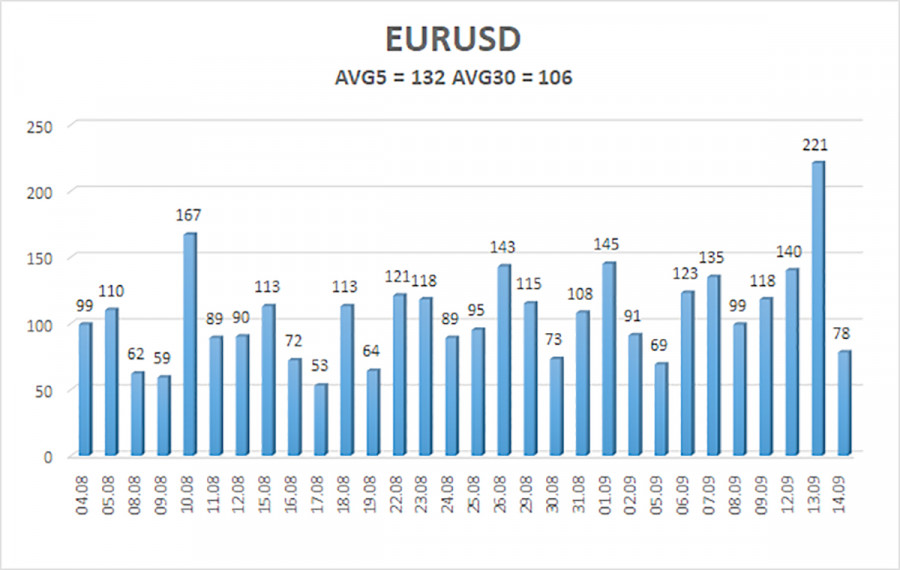

The average volatility of the euro/dollar currency pair over the last five trading days as of September 15 is 132 points and is characterized as "high." Thus, we expect the pair to move today between 0.9857 and 1.0121. A reversal of the Heiken Ashi indicator back to the top will signal a possible resumption of the upward movement.

Nearest support levels:

S1 – 0.9949

S2 – 0.9888

S3 – 0.9827

Nearest resistance levels:

R1 – 1.0010

R2 – 1.0071

R3 – 1.0132

Trading Recommendations:

The EUR/USD pair is trying to resume the global downward trend. Sell orders should now be considered if the price remains below the moving average line with targets of 0.9888 and 0.9857. Buy orders should be opened if the pair is fixed above the moving average, with targets of 1.0132 and 1.0193.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which to trade now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.